FilmLA, partner film office for the City and County of Los Angeles and other local jurisdictions – today issued a pair of updates regarding regional film production activity. The first of these reports examines on-location filming in the second calendar quarter of 2024. The second report examines stage-based production during the first half of calendar year 2023.

On-Location Production Report: Seasonal Analysis

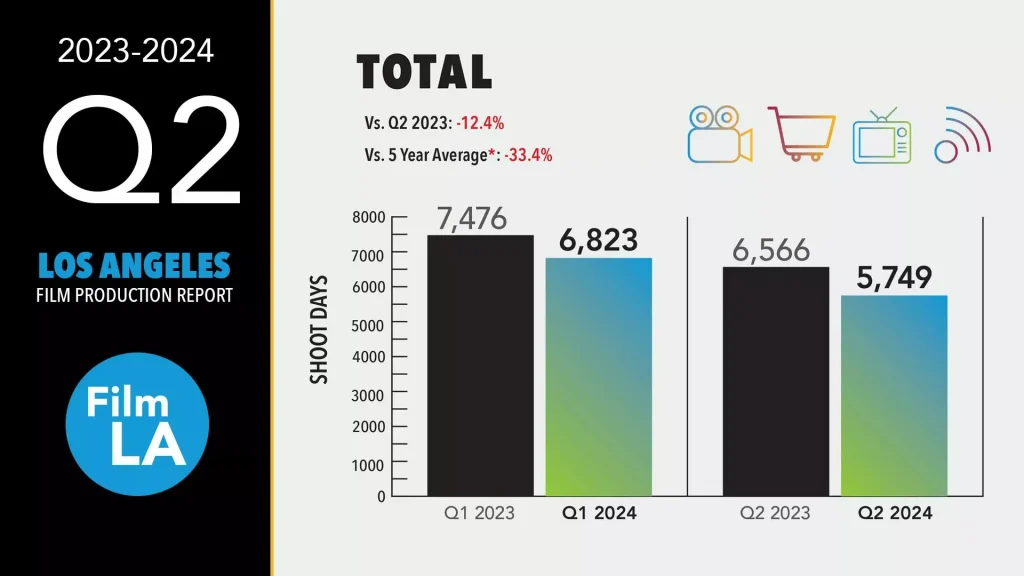

Local on-location filming declined -12.4 percent year-over-year from April through June, attaining 5,749 Shoot Days (SD)* in the second quarter of 2024. Observed dips in Feature Film production (down -3.3 percent to 704 SD) and Commercial production (down -5.1 percent to 817 SD) both looked minor when compared to a steep plunge in unscripted television production.

Filming of Reality TV fell -56.9 percent to 868 SD, taking the broader Television category (down -27.7 percent to 1,901 SD) lower with it.

Elsewhere within the Television category, scripted content production increased substantially for the period, compared to the earliest strike-affected months of 2023. TV Drama production rose 98.3 percent to 714 SD, and TV Comedy production rose 103.6 percent to 171 SD, while filming for TV Pilots rose 54.5 percent to 17 SD.

“Generally speaking, unscripted television is a location-heavy format that generates significant permit volume,” said FilmLA’s VP of Integrated Communications Philip Sokoloski. “The employment impact of reality production is lower than it is for scripted TV, and projects are not incentive-eligible through the State of California. It remains an important part of LA’s production economy.”

Reality TV series that filmed locally last quarter included Accident, Suicide or Murder (Oxygen), American Idol (ABC), John Mulaney Presents: Everybody’s in LA (Netflix), 90 Day Finance (TLC), The Golden Bachelorette (ABC), The Real Housewives of Beverly Hills (Bravo) and Selling Sunset (Netflix).

Most Feature projects filmed in the region last quarter were independent films. Two films, Dreamquil and Lurker, were produced with support from the California Film & Television Tax Credit Program. Other independent films in production included Nickels, The Prince, and Watch What You’re Doing. Two streaming companies filmed feature projects on-location, including Bubbi (Apple Studios) and Mercy (Amazon), the latter in connection with the California state film incentive.

Television shows that filmed on-location in Los Angeles last quarter included incentive enrolled projects Forever S1 (Netflix), High Potential S1 (ABC), Matlock S1 (CBS), Orphan S1 (ABC), Paradise City S1 (Hulu), S.W.A.T. S7 (CBS), and The Rookie S7 (CBS). Also filming were Bookie S2 (HBO Max), Bosch Legacy S3 (Freevee), Shrinking S2 (Apple TV+), 9-1-1 S7 (Fox), and Suits: LA S1 (NBC).

Commercial productions are not incentive eligible in California, and have become attractive targets for other film jurisdictions. In Greater Los Angeles, many car companies such as Ford, Honda, Lexus, Mazda, Nissan, Subaru and Toyota all shot commercials in the second quarter, along with spots for major brands Google, Lululemon, Sam’s Club, Spectrum, Starbucks, Verizon and Walmart.

FilmLA’s “Other” category, which aggregates smaller, lower-cost shoots such as Still Photography, Student Films, Documentaries, Music and Industrial Videos and other projects, declined -0.9 percent (to 2,327 SD) for the quarter.

On-Location Production Report: Historical Analysis

The WGA and SAG-AFTRA labor actions reduced industry output in 2023, but a sustained pattern of production decline had been evident before the strikes began.

The chart from FilmLA Research on page three of today’s report illuminates the slide, which has unfolded over time and affects all top production categories. As revealed on page four, on a rolling five-year basis**, overall on-location filming levels heading into summer are down -33.4 percent below their five-year seasonal average.

“Streaming content spend is down, and Los Angeles and its many global competitors are still reeling from post-strike paralysis,” said FilmLA’s Philip Sokoloski. “Workers in this industry, wherever they are based, are seeing fewer opportunities amid ongoing labor negotiations in an era of content contraction.”

Philip Sokoloski, FilmLA VP of Integrated Communications

FilmLA analysts point out that for the studios that produce, purchase and distribute entertainment content, investor emphasis on financial austerity/profitability over new subscriber growth, plus a wave of corporate consolidation, continues to limit new content investment.

“Given that there was a double strike in effect in late 2023, it’s likely the rest of this year will look better — on paper,” Sokoloski noted. “An authentic production lift is also possible, pending successful contract negotiations. If we see new content investment, it will be cautious and measured, and the gains will be globally distributed.”

Sound Stage Production Report: January-June, 2023

Today FilmLA also updated its regional survey of sound stage occupancy and certified studio-based production. The report can be found here.

Notes on This Report

* On-location production figures are based on days of permitted production within the jurisdictions served by FilmLA. One “Shoot Day” (or “SD”) is defined as one crew’s permission to film at one or more defined locations during all or part of any given 24-hour period.

** FilmLA’s reported five-year average excludes 2020, which due to the significant impact of COVID-19 on production that year, distorts all historical comparisons.