FilmLA, partner film office for the City and County of Los Angeles and other local jurisdictions, today issued an update regarding regional filming activity.

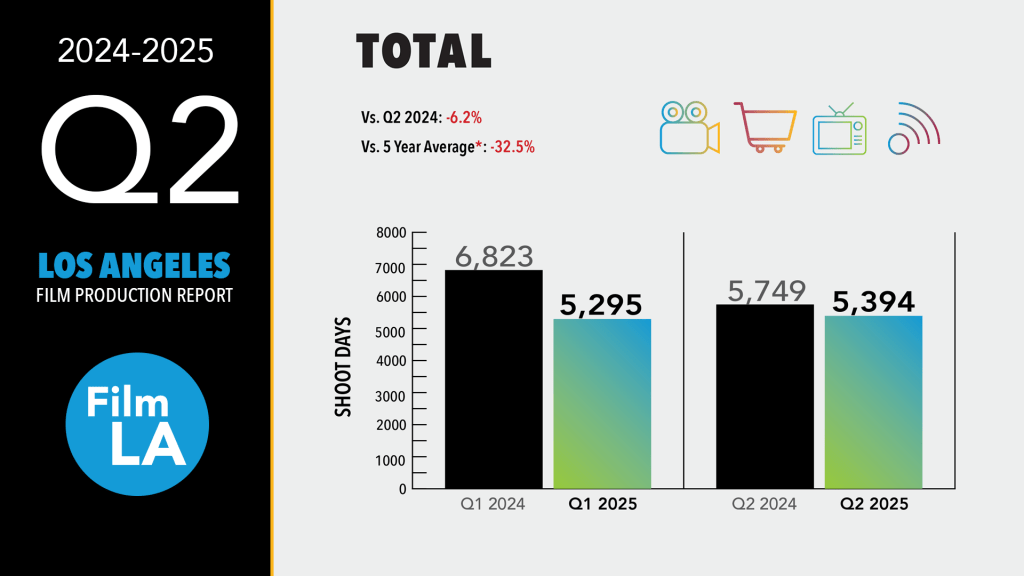

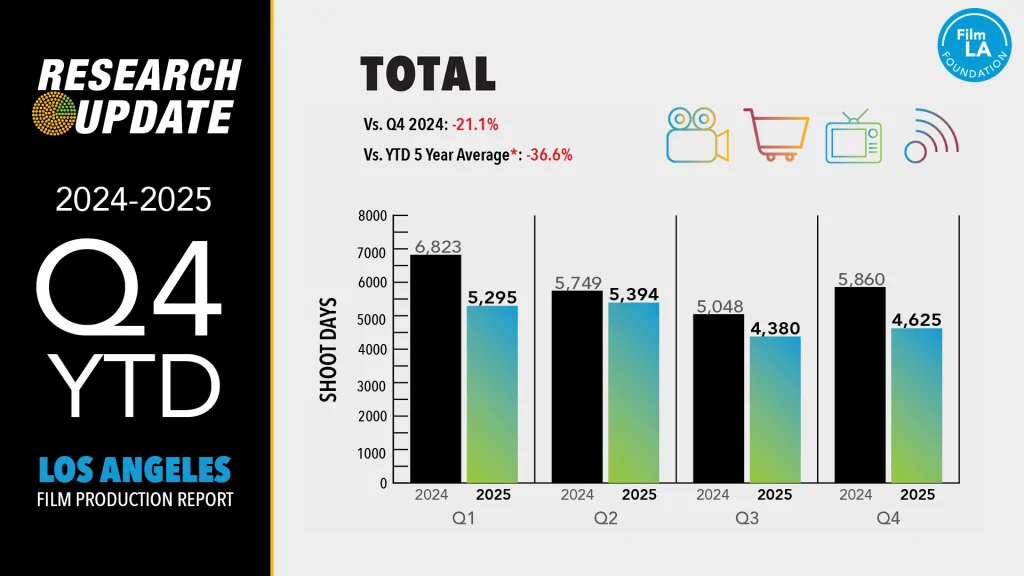

Overall, on-location production in Greater Los Angeles declined by 6.2 percent to 5,394 Shoot Days (SD)* in Q2 (April-June) of 2025 compared to the same period a year ago according to FilmLA. Over those same months, a multi-party coalition of studio and independent filmmakers, entertainment union and guild members, film offices from around the state, entertainment vendors, business advocates and grassroots activists gathered in Sacramento to campaign forcefully on behalf of California’s signature industry and the creative livelihoods it sustains. FilmLA played a supporting role being called as experts to testify at the Assembly’s first hearing in March, participating on local industry panels and equipping the California Production Coalition and Film Liaisons in California, Statewide (FLICS) with Research Briefs.

FilmLA publicly called for a “vast expansion” of the California Film & Television Tax Credit Program last October, joining other organizations in sounding the alarm over unprecedented levels of local production loss.

Nine months later, the modernization of the California Film & Television Tax Credit Program by Governor Newsom and the California State Legislature aims to immediately create jobs through $750 million in job creation support and expanded filmmaker access. In addition to expanding the qualification parameters, the legislation increased the available credit amount for an individual project from 20 to 35 percent. AB1138 (Zbur/Bryan) also raised the per-production incentive cap from $100M to $120M and tripled total program funding for independent films from $26M to $75M. Film tax credits are also now refundable in California, beginning with the 2025-26 fiscal year.

“FilmLA is elated with the news of the passage of the California Film & Television Tax Credit Program by the California State Legislature,” said FilmLA President Paul Audley. “We are grateful to our partners and collaborators across the industry and in government who joined together to advocate for a stronger, modernized, and revitalized California where production can thrive once again.”

Relief cannot come soon enough for Feature producers, who generated just 553 SD in the second quarter, 21.4 percent fewer than in Q2 2024. On a positive note, this was 22.6 percent more than in Q1 2025. All of the feature films shot locally last quarter were independent productions. Titles included Animals, I’ll Take the Hamm, Totally Ghosted, Unravel, and Whalefall. The California Film Commission recently announced the approval of a new feature production round of 48 projects, which includes 5 major studio films, 6 independently produced projects with budgets in excess of $10M, and another 37 with budgets less than $10 million.

Faring better last quarter were television producers, who brought more Shoot Days to LA-area communities than FilmLA has seen since early 2024. The 2,224 SD logged for the Television category last quarter represents a year-over-year increase of 17.0 percent. Unfortunately, the Television category is still down -32.6 percent over its five-year quarterly average.

The increase in local television production can be attributed to gains for TV Dramas (up 9.5 percent) and TV Reality (up 29.5 percent). In fact, TV Dramas with 782 SD posted their highest observed levels since pre-strike period Q4 2022 (with 1,155 SD). Television series shot last quarter included High Potential S2 (ABC), 9-1-1 S8 (Fox), Untitled Snowfall Spinoff (FX), Lincoln Lawyer S4 (Netflix), Paradise S2 (Hulu), Shrinking S3 (Apple TV+), and The Burbs (Peacock).

TV Reality production, at 1,124 SD last quarter, reached their strongest level since Q1 2024 (with 1,317 SD). TV Reality shows included American Idol (ABC), Let’s Make a Deal (CBS), 90 Day Fiancé (TLC), House of Villains (E!), Vanderpump Rules (Bravo!), Everybody’s Live in LA (Netflix).

Commercial production, which receives no form of business incentive to create production jobs in California, declined -15.3 percent last quarter to 692 SD. The Commercials category remains -38.3 percent below its five-year quarterly average – making it the weakest of the three major production categories tracked by FilmLA. Commercial spots for companies such as Adidas, Amazon, Geico, McDonald’s, Iron Mountain and Walmart helped by filming locally. Los Angeles also continues to be a popular filming destination for car manufacturers like BMW, Ford, Hyundai, Infiniti, Nissan, Subaru, and Toyota.

FilmLA’s “Other” Category, which collectively includes still photo shoots, student films, documentaries, short films, online content, plus music and industrial videos, declined -17.3 percent compared to the same period and year and -29.8 percent over the category’s five-year average.

“While there is work ahead to bring Los Angeles-area production back to its full potential, we are optimistic and grounded in our mission to keep production affordable, accessible and straightforward,” said FilmLA President Paul Audley.

“We look forward to our continuing conversations with government officials and our partners in the industry to see the full fruition of the economic, cultural, and employment benefits that Los Angeles’s film ecosystem offers to our community. We remain dedicated to working with our union partners, independent and major studios, and community organizations until there’s no better place to film in the world than right here in Los Angeles.”

Paul Audley, FilmLA President

* On-location production figures are based on days of permitted production within the jurisdictions served by FilmLA. One “Shoot Day” (or “SD”) is defined as one crew’s permission to film at one or more defined locations during any 24-hour period.

** FilmLA’s reported five-year average excludes 2020, which due to the significant impact of COVID-19 on production that year, distorts all historical comparisons.